PDF version available (here)

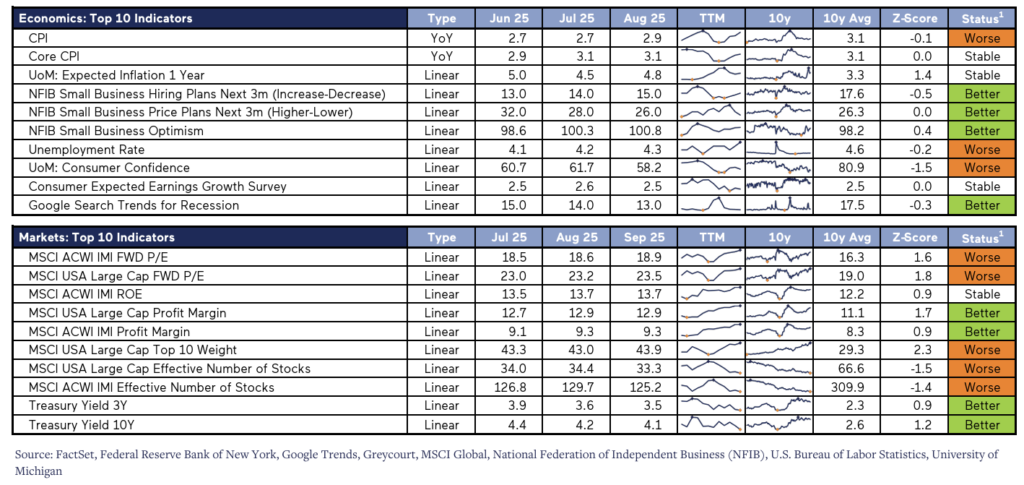

- CPI inched higher while Core CPI stuck to last months reading of 3.1% on a year over year basis; increases in food prices were modestly held back by declining energy prices

- Markets have fully priced in at least a 25bps cut to the policy rate at the Sep 17th Fed meeting; we believe it is unlikely to see a 50bps cut due to inflation hovering near 3%

- Yields have declined precipitously to the lowest levels since Sep 2022 / 1-year, Jul 2022 / 3-year, and Sep 2024 for the 10-year treasury

- American main streets paint an improving picture for consumers and businesses alike; plans to hire are improving while the rate of price hikes are calming down >> Unemployment has ticked up for three months in a row, but has remained well below levels of concern for the broader economy

- Diversification remains key to investing in public equities; concentration in US Large Cap is at all-time highs in terms of the weight of the top 10 and the effective number of stocks

- Despite high price multiples and record levels of concentration, fundamentals are strong with profit margins and equity index return-on-equities near their highest levels