Download the white paper here »

Markets trade in cycles and, as most of you know, it is presently our view is that we are entering a challenging environment for risk assets. With that said, we also believe that there is reason for long-term optimism. As has happened many times in the past, transformative technologies will soon alter the way we live our lives and shape our economies. Greycourt’s White Paper, “Is the Glass Half Full?” touches on several of these looming advancements and how they might impact our future.

The stock market is often seen as a reflection of the economy, with investors buying and selling shares of companies based on their perception of future earnings potential. It is a complex system, and investors have many factors to consider when making investment decisions.

One factor that investors often underappreciate is the impact new technologies have in driving future economic growth and, by extension, stock market returns. Emerging technologies can disrupt entire industries, create new opportunities for growth, and transform the way companies operate. In this white paper, we explore why investors often fail to appreciate the impact of emerging technology.

Background

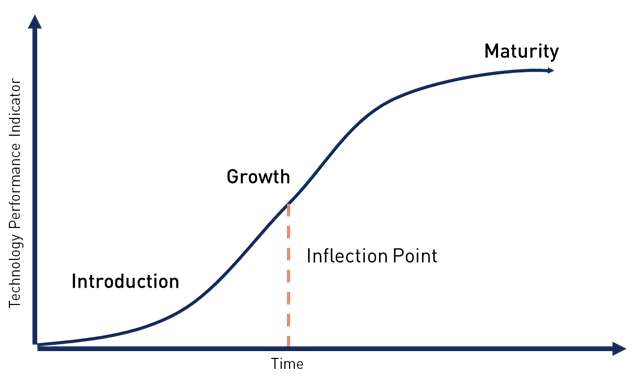

The technology s-curve is a useful framework for understanding the adoption and diffusion of new technologies. The s-curve is based on the idea that when a new technology is introduced, it takes time for it to gain widespread acceptance. At first, adoption is slow, but as more people become familiar with the technology, adoption accelerates. Eventually, the technology reaches a point of saturation where most people who are interested in using it have already adopted it. At this point, growth slows down, and the new technology becomes a mature product.

The technology s-curve is useful because it can help investors identify which stage of the curve a technology is in. This can provide insight into the potential growth and profitability of companies that are involved in the development and deployment of technology.

The introduction of new technologies has brought about many seminal economic changes throughout history. Some of the more significant include:

The Industrial Revolution: The introduction of new manufacturing technologies such as the steam engine, power loom, and spinning jenny enabled mass production of goods and transformed the way goods were manufactured. This led to increased production, lower costs, and increased efficiency, and was a significant driver of economic growth.

Transportation: The development of the steamship, railroads, and then the automobile revolutionized transportation and enabled goods to be transported more quickly and cheaply than ever before. This led to expanded trade and increased economic integration across regions and countries.

Electricity: The widespread adoption of electricity in the late 19th century transformed many industries, from manufacturing to transportation. Electricity enabled the development of new forms of lighting, communication, and transportation, and paved the way for the growth of new industries such as electronics and telecommunications.

Agriculture: The development of new agricultural technologies such as the mechanical reaper and the seed drill enabled increased efficiency and productivity in farming, leading to increased agricultural output and lower food prices.

These technological changes, among others, transformed the economic landscape of the 19th and 20th centuries, enabling new forms of production, consumption, and exchange. They also led to significant social and economic changes, including the growth of cities, the rise of new industries, and the development of new social and economic structures.

Today, we are on the cusp of developing many new and exciting technologies that promise to further change the way we work, how and where we manufacture goods, the kinds of jobs suited to the human workforce and how we interact with the technology we use. A few examples of such potentially transformative technologies include:

Artificial Intelligence (AI) has been one of the most talked-about technologies in recent years. AI has the potential to transform numerous industries, from healthcare to transportation to finance. In the finance industry, AI is already being used to help with fraud detection, trading, and investment analysis. One potential impact of AI on the stock market is increased efficiency. AI algorithms can analyze vast amounts of data more quickly and accurately than humans. This could lead to more efficient market analysis and trading, which could improve returns for investors. Additionally, AI could help identify and mitigate risks more effectively, leading to more stable returns over time.

Another potential impact of AI on the stock market is increased volatility. AI algorithms can make decisions more quickly than humans, which could lead to more frequent and rapid changes in stock prices. This could create opportunities for short-term gains but could also increase risk for investors who are not able to keep up with the pace of AI-driven trading.

Quantum computing is another emerging technology that has the potential to impact stock market returns. Quantum computers are fundamentally different from classical computers, as they use quantum bits (qubits) to perform calculations. Quantum computing is still in its early stages, but it has the potential to revolutionize industries such as finance, logistics, and materials science.

One potential impact of quantum computing on the stock market is increased speed and efficiency. Quantum computers could be used to perform complex financial calculations much more quickly than classical computers. This could lead to faster and more accurate stock market analysis and trading, which could improve returns for investors.

Another potential impact of quantum computing on the stock market is increased security. Quantum computers can be used to create unbreakable encryption, which could help prevent cyberattacks and other security breaches that can impact stock prices. This could lead to a more stable and secure stock market, which could improve returns for investors.

Clean Energy Transition is a global trend that has the potential to significantly impact the stock market. As the world transitions away from fossil fuels and towards renewable energy sources such as wind and solar power, the companies that produce and distribute clean energy will likely see increased demand and profits.

One potential impact of the clean energy transition on the stock market is increased investment opportunities. As more companies invest in renewable energy, there will be more opportunities for investors to get involved in this sector. This could lead to increased returns for investors who are able to identify profitable investments in the clean energy sector.

Another potential impact of the clean energy transition on the stock market is increased volatility. As the world transitions away from fossil fuels, there may be significant disruption in traditional energy markets. This could create volatility in the stock prices of energy companies, which could impact returns for investors.

Automation and Robotics has led to significant changes in the manufacturing sector, with many tasks previously performed by human workers now being carried out by machines. This has led to increased efficiency and productivity but has also raised concerns about job displacement and inequality.

Healthcare Advancements promise to further reduce the mortality rate and prolong human life. Increases in life expectancy around the world have already shifted the way people view retirement, and how their retirement savings are managed. In a way, healthcare advancement has already been responsible for creating rapidly aging societies observed across developed economies. Today, technology is pushing new frontiers of research & development in precision medicine, 3-D printed body parts, medical imaging & telemedicine, bringing new treatments and drugs to healthcare providers and their patients all around the world.

The Glass Half Empty Scenario

When seeking to divine the path of corporate profits, interest rates and the stock markets, it is easy to become pessimistic by obsessing over the looming problems facing the global economy in the coming years and to believe that stock returns will merely be an anemic shadow of their former levels. Population growth is already slowing dramatically and is forecasted to begin falling by the year 2100. Geopolitical stresses are increasing leading to a heightened risk of serious military conflict or at least the possible dismantling of the global trade network that propelled millions out of poverty over the past 75 years. And unwinding the excessive leverage accumulated over the past several decades threatens to weigh on economic growth as the world leans to live within its means.

The Glass Half Full Scenario

But we shouldn’t despair. Technological advances can create new attractive growth opportunities that more than offset the hurdles we face. But investors often underappreciate the impact of emerging technologies on stock market returns, due in part to the S-curve issue

discussed above.

Naturally, it can be difficult to identify which technologies will have a significant impact on the market and which will fizzle. Finally, investors may be reluctant to invest in emerging technologies because they are often associated with high levels of uncertainty and risk. However, we believe that the impact of emerging technologies will be so profound that investors are likely to be well-rewarded for sifting through the opportunities, ignoring the inevitable hype, and focusing on those technologies that offer the most future advantages.